Q&A with Susan Holliday, Senior Advisor, International Finance Corporation and Triple-I Non-Resident Scholar

By Marielle Rodriguez, Social Media and Brand Design Coordinator, Triple-I

3/25/21

Triple-I’s “Insurance Careers Corner” series was created to highlight trailblazers in insurance and to spread awareness of the career opportunities within the industry.

March is Women’s History Month, and this month we interviewed Susan Holliday, a Senior Advisor at the International Finance Corporation (IFC) and the World Bank where she focuses on insurtech and insurance for SMEs and women. She is also a non-resident scholar at the Triple-I. Holliday sat down with us to discuss developing trends in insurtech, how technology and innovation can help close the protection gap, and the importance of collaboration in tackling climate risk.

Tell us about your current role at the International Finance Corporation (IFC). How did you fall into a career as an advisor and an investor in insurance?

IFC is the private sector arm of the World Bank. We focus on making investments and advisory work in emerging markets in sectors ranging from infrastructure to banking and insurance and healthcare. I’ve had a 33-year career in the financial services industry, particularly focusing on insurance and more recently fintech. I joined IFC to work on insurance and fintech. I’m currently working within different departments at IFC and at the World Bank and building a board portfolio. I’m also a non-resident scholar for the Triple-I.

A lot of your work is focused on insurance for women and SMEs. What do you hope to achieve in investing in insurance for women?

Before I joined the IFC in 2015, the company completed research in conjunction with Accenture and AXA about the insurance market for women. The study found that the insurance market for women could be USD 1.3 trillion globally by 2030 and half of that would be in emerging markets. The research also indicated that women have a better understanding of risk, are very open to insurance, and can be loyal customers and excellent employees in the industry.

After the She for Shield report was published, IFC started advising insurance companies in emerging markets on how to successfully serve women. IFC already had a program called ‘Banking on Women,’ which provided financing for banks to lend to women and women-led SMEs. Whenever we make investments in emerging markets, we are interested in taking an angle that better supports women.

Can you elaborate on the protection gap between women and men and between people with different financial backgrounds?

If you think about it, the insurance industry has a great history and is hundreds of years old. A lot of products were developed a long time ago when society and family structures were very different from what they’re like now. For example, today there are lots of single women and single parents, and most women work, which was not the case when the products were developed. We also have gig economy workers. The default option has always been to continue to offer products that have been offered for 50-100 years, but they do not necessarily meet the needs of today’s customers, whether they are women or men.

This is the reason why I like technology and innovation. To close the protection gap, we need to protect the things that people care about and that need to be protected. There has been a mismatch between traditional products and the actual risks people are facing.

There’s been a report by the Chartered Insurance Institute called “Insuring Women’s Futures” which looked at different times over a lifetime of one person, and it shows where a woman can be treated differently than a man. For example, having time off for maternity leave, having less pension, and living longer. It pointed out all these things that could accumulate and leave a woman being in a much worse position [than men]. Families are no longer a guy who’s working, a stay-at-home woman, and kids. Insurance needs to catch up to reality, and this not only applies to women but all underserved communities. This will not only be a challenge for the industry but also an opportunity to grow.

As an advisor to insurtech start-ups, what impact do you see these companies making? Are there any recent trends or developments in insurtech and fintech that excite you?

I think insurtech, digital, and innovation are critical. There is no insurance without insurtech. We’re never going to close the protection gap unless we use and utilize new technologies to do it.

One of the trends is bite-size insurance on demand. For example, instead of buying an insurance policy for a year, you would be able to turn it on and off, which is relevant to gig economy workers, and is popular in developing countries. Some people would rather access [insurance] when they need it.

Another trend is using alternative data to close the protection gap and get insurance to more people. If we just rely on the old sources of data, a lot of people get excluded from the market or get priced out. It may have built-in biases, which were not intended, but may disadvantage women or certain racial groups. The combination of alternative data sources and artificial intelligence is exciting.

You’re part of the leadership team for Triple-I’s Resilience Accelerator. Tell us about your work with the initiative and why you chose to join the team.

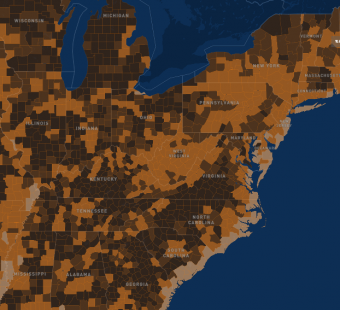

An area where the protection gap is big in the U.S. is in natural disasters and climate-related risks. We’ve seen so many things happen in recent years, such as Hurricane Harvey, and most recently, the very cold snowstorms in Texas and the wildfires on the U.S. West Coast. I think this is an extremely important area. It’s something that impacts everybody, regardless of gender, income level, or political identity.

I particularly like Accelerator, because I think insurance has a bigger role to play in prevention and mitigation, not just about compensation, and I like the approach of bringing different stakeholders together.

2020 was a historic year for natural catastrophe losses. What is the insurance industry doing to mitigate future losses and to prepare for a world impacted by climate change? What are the industry’s biggest challenges in creating resilience?

First and foremost, making insurance more available and more affordable. For example, there is parametric, index-based insurance, which can be provided at a micro-level and is used in some developing countries.

We need to get involved in longer-term thinking about how we can be more resilient against these risks in the first place. We must think about building towns, cities, and farmland in a way that they will be more resilient against weather losses. It has to do with planning, infrastructure, and it may have to do with changing certain industries.

I would like to see the insurance industry at the table in these discussions with regulators, local and state governments, and with private sectors so that all sides are working together. The industry needs to have a voice and be taken seriously. We need to think about how different parts of society can share the risk of climate-related losses.